Introduction

The banking and finance industry is undergoing a profound transformation driven by digital technologies. From customer interactions to backend operations, digital transformation is reshaping how financial institutions operate, deliver services, and engage with clients. This article explores the key aspects and implications of digital transformation in the banking and finance sector.

**1. Mobile Banking and Digital Channels

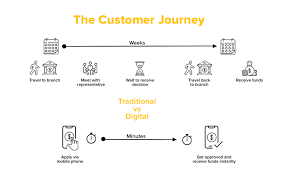

The rise of mobile banking and digital channels has redefined how customers interact with financial institutions. Mobile apps and online platforms offer users convenient access to a wide array of banking services, from account management to fund transfers. The shift towards digital channels has resulted in increased customer autonomy and reduced reliance on physical branch visits.

**2. Contactless Payments and Digital Wallets

Contactless payments and digital wallets have become mainstream, offering users a secure and efficient way to conduct transactions. The integration of Near Field Communication (NFC) technology allows users to make payments using smartphones, wearables, or contactless cards. This shift not only enhances transaction speed but also contributes to a seamless and enhanced customer experience.

**3. Data Analytics and Personalized Banking

Data analytics is empowering financial institutions to gain valuable insights into customer behavior, preferences, and financial patterns. By leveraging big data and analytics, banks can offer personalized services and tailored product recommendations. This enhances customer engagement, loyalty, and the overall effectiveness of marketing and sales strategies.

**4. Artificial Intelligence (AI) in Financial Services

Artificial Intelligence is revolutionizing various aspects of financial services. Chatbots and virtual assistants powered by AI provide instant customer support, answering queries and assisting with transactions. AI algorithms analyze data to detect fraud, assess credit risks, and automate routine tasks, contributing to increased efficiency and risk management.

**5. Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are transforming the way transactions are recorded and verified. The use of blockchain in financial services enhances security, transparency, and reduces the need for intermediaries. Applications range from cross-border payments to smart contracts, offering a decentralized and tamper-resistant infrastructure.

**6. Robotic Process Automation (RPA) for Efficiency

Robotic Process Automation streamlines repetitive and rule-based tasks within financial processes. RPA bots can automate tasks like data entry, account reconciliation, and compliance checks, reducing errors and operational costs. This automation allows financial institutions to allocate resources more strategically and focus on higher-value activities.

**7. Cybersecurity and Fraud Prevention

As digital transactions proliferate, cybersecurity becomes a paramount concern. Financial institutions are investing heavily in advanced cybersecurity measures to protect customer data, secure online transactions, and prevent fraud. Biometric authentication, multi-factor authentication, and continuous monitoring are integral components of cybersecurity strategies.

**8. Open Banking and API Integration

Open Banking initiatives promote collaboration and interoperability within the financial ecosystem. APIs (Application Programming Interfaces) enable different financial institutions and third-party developers to integrate services seamlessly. This fosters innovation, allowing customers to access a broader range of financial products and services from multiple providers within a unified platform.

**9. Cloud Computing for Scalability

Cloud computing has become a foundational element in the digital transformation of banking and finance. Cloud-based solutions offer scalability, flexibility, and cost efficiency. Financial institutions leverage the cloud to host applications, store and analyze data, and deploy new services without the constraints of traditional infrastructure.

**10. RegTech for Compliance and Regulatory Management

Regulatory Technology (RegTech) solutions assist financial institutions in navigating complex regulatory landscapes. These technologies automate compliance processes, monitor regulatory changes, and ensure adherence to evolving standards. RegTech enables financial institutions to stay compliant while mitigating regulatory risks efficiently.

Conclusion

Digital transformation is not just a trend but a fundamental shift reshaping the banking and finance industry. Embracing digital technologies is imperative for financial institutions to remain competitive, meet evolving customer expectations, and navigate the complexities of a rapidly changing landscape. As digital transformation continues to unfold, the collaboration between technology and finance will drive innovation, efficiency, and improved customer experiences.